What a journey!

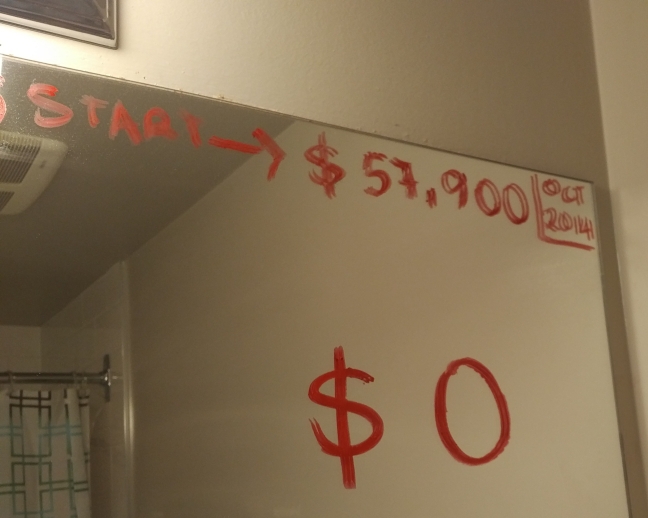

The borrower is a slave to the lender. I’m definitely unshackled now. Three years and nine months later, I paid the last bit of my $57, 900 student loan debt and have no other debt. I cannot describe this feeling! Although I would do things a bit differently were I to return to school, I definitely appreciate the journey and the lessons on money that the last few years afforded me. Here are some of the things I did.

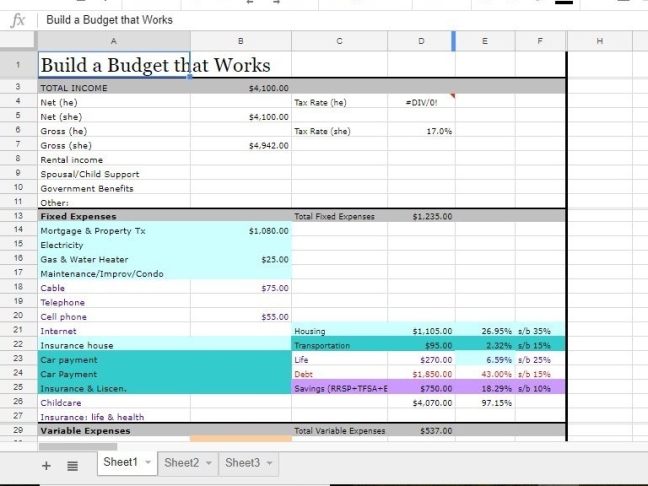

- Build a Budget

The first budget I ever built (2014) …and make sure it works! It took me months to come up with a budget that balanced and aligned with the goals I wished to accomplish. Once it balanced, it was one of the ways I was able to tell my money exactly where it was going. Every cent was accounted for and every dollar I earned above my net income went straight to debt repayment. Now every dollar that I am no longer going to be spending on debt will be going into my awesome retirement fund and savings account. I was anticipating this day so much that I doubled my contributions to the respectable accounts as soon as I made that last payment.

- Read widely on the subject and crunch the numbers.

Gail Vaz-Oxlade during her ‘Money Talks’ book tour (2015) I initially did the math to see how much I would be freely handing the student loan company if I opted to pay the debt over 10 years. My hard work would have given them $20,000 whereas my 45 months gave them $7,000. Damn, I wish I gave them even less or none at all. They no longer gain from me so I can be happy about that and take my $13,000 to the bank. In addition, I cannot tell you how many books I read to steer me in the right financial direction and propel me forward. I needed to learn and understand money. I read every Warren Buffet, Gail Vaz-Oxlade and Dave Ramsey book available. I read blogs by Mr Money Mustache and JL Collins and listened to every podcast by the Mad FIentist. What worked and still works for me is people that are upfront and are not afraid to ‘hurt my feelings’ when it comes to money. That is why I still listen to Dave Ramsey and get giddy every time someone wants to delve into conversations about money.

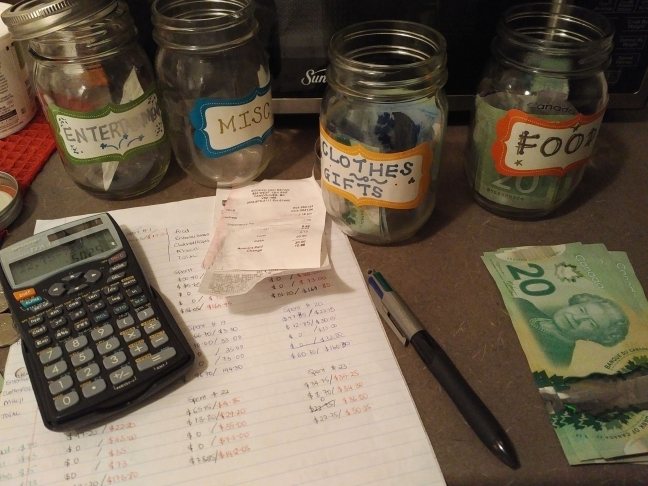

- Have a method and stick to it!

My bi-weekly money reconciliation days. In keeping with my budget and debt repayment plan, I had to have a way to live that was clear, succinct, and intentional. Cash became king…and I have over three years worth of records of how I spent, if and when I overspent which was rare, when I won with money and had money left over in my jars, and when I needed to change my cash amounts. This allowed me to have more money to throw against my debt and hit it hard. As well, for me, using cash stung way more than swiping a card for transactions so I kept my card use to a minimum and will continue to do so. This method has created the discipline of planning and being mindful of my expenditures.

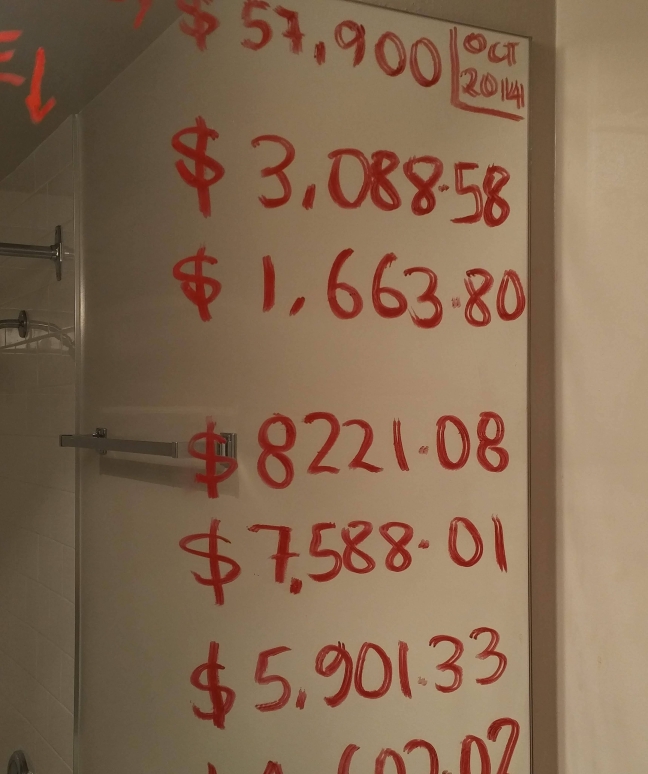

- Visualize It!

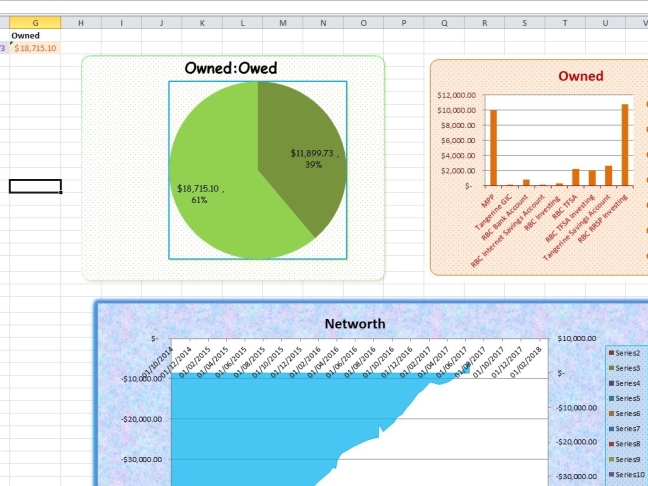

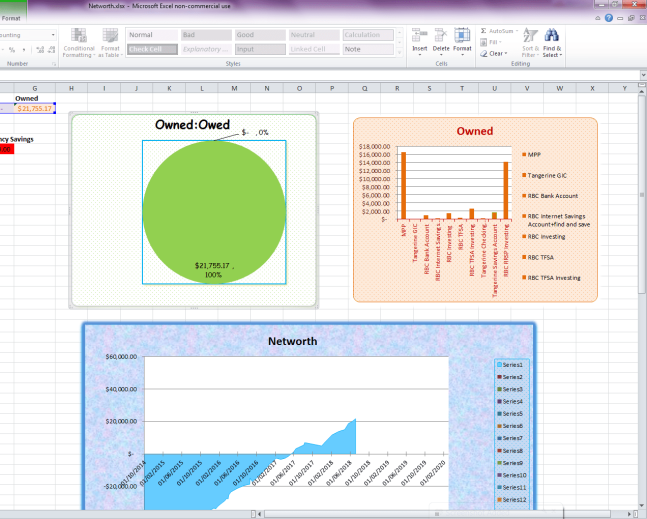

Bathroom mirror reflections Having it staring at my face all the time as I used the throne, after a shower, when I washed my hands, when doing my makeup…this was not going to get ignored and it forced me to think of ways I could accelerate my payments and gave me the impetus to look forward to the next bathroom mirror update. It also became a good conversation starter with guests. Now it’s $0…I need to update that! Being one who enjoys forward movement, having an overkill type of spreadsheet also helped me to visualize my spending, my saving and my overall progress. Being in the negative in terms of networth was initially discouraging but seeing my networth go up as I attacked the debt was like salve to my soul.

A year ago when I had just newly broken into the positive networth. (2017)

No more owed and a definitely positive networth - Talk About It! There’s nothing to keep you accountable like talking about it. At first, people think you’re weird when you openly admit to having debt and respect you once they see that you’re doing something about it. Many also admit to their own money follies and will ask for advice in changing their money habits. Money is, sadly, a taboo topic in our society and a lot of people are happy to pretend that they have money on the outside although are living with heaps of anxiety on the inside. It scares me to catch wind of statements like, “I have 23 cents between now and my next pay cheque” yet I have sympathy because I have lived like that in the past and refuse to live like that ever again.

- Life Happens! Having two major life emergencies happen just when I was getting intense on my debt repayment did not need to take me back into the financial red. Having a healthy emergency savings in place instead of using my credit card and struggling to pay it back later was helpful each time. The emergencies became a financial pause rather than a financial setback and I was still able to continue with life without the anxiety that comes along with not being prepared when emergencies strike. I cannot emphasize enough the importance of an emergency fund!

- Celebrate it! I am going to celebrate it big! Actually, there will be a series of celebrations. However, celebrating does not mean that I will suddenly change my lifestyle or become extravagant in my spending habits. What I have learnt in this journey is for a lifetime.

Ok…it’s updated…DEBT FREE!!!